Private LTE networking: a next step for Enterprise IoT?

Private Wi-Fi networks have been around for a couple of decades, and this communication medium is taken for granted in business premises for indoor use. Wi-Fi 6, the next-gen standard, runs faster; it improves overall network performance, but what these networks cannot do is accommodate data-centric, business-critical IoT applications. They also have difficulty with moving assets and are not good for outdoor use; therefore, there is a need for a business-centric network that can deliver the requisite functionality and performance, and LTE/4G fits the bill. In fact, it fits several bills; the different requirements of very large organisations, as well as medium-to-large sized enterprises.

LTE-Advanced Pro’s peak rate of 1 Gbps and latency less than 50 millisecond are state-of-the-art figures, more than adequate for most of today’s IoT business applications. Bandwidth can be assigned in a very flexible way; it enables cost-effective low data services at one end of the spectrum (NB-IoT and LTE-M) and high data rates at the other. Moreover, deploying network slicing enables connectivity to be customised to match the performance requirements of different applications and use cases.

On the performance front LTE is clearly a good fit for private business networks, which are a development that helps the digital transformation process across the industrial board. Vertical sectors such as logistics, energy, mining, transportation, manufacturing, venues and smart cities all have examples for Enterprise IoT use. So, is it a no brainer? Is the market for private LTE taking off? The answer to both questions is a definite yes, but that raises the question of how is it being deployed? Fundamentally, it depends on spectrum allocations.

Solutions can employ licensed, unlicensed or shared spectrum. The public networks of MNOs use licensed spectrum. The availability and regulation of unlicensed LTE spectrum depends on the country. Networks can also employ a combination of licensed and unlicensed spectrum, and it can also be shared or “lightly licensed”. There is no one-size-fits-all solution, which indicates that the market is open to incumbent operators as well as new entrants.

Developments in this space include LTE-U, that makes better use of unlicensed spectrum and delivers better network performance. MulteFire, a new, LTE-based technology that combines the performance benefits of LTE with the simplicity of Wi-Fi type deployments and envisaged for deployment in several frequency bands. And in the U.S. the 3.5 GHz CBRS band.

History tells us that when markets like private networks have enormous potential and when they are wide open to new entrants, that will normally result in the creation and deployment of innovative solutions and new business models.

Those solutions and models are out there, but within the confines of this short article we can only outline a handful. The first indicates how an MNO can leverage its core asset, i.e. licensed spectrum. The second involves what would normally be classified as a new entrant, but they have been in this market from the very beginning. The third employs both unlicensed and licensed technology which is used to create an innovative business model.

Three proofs of the LTE private network pudding

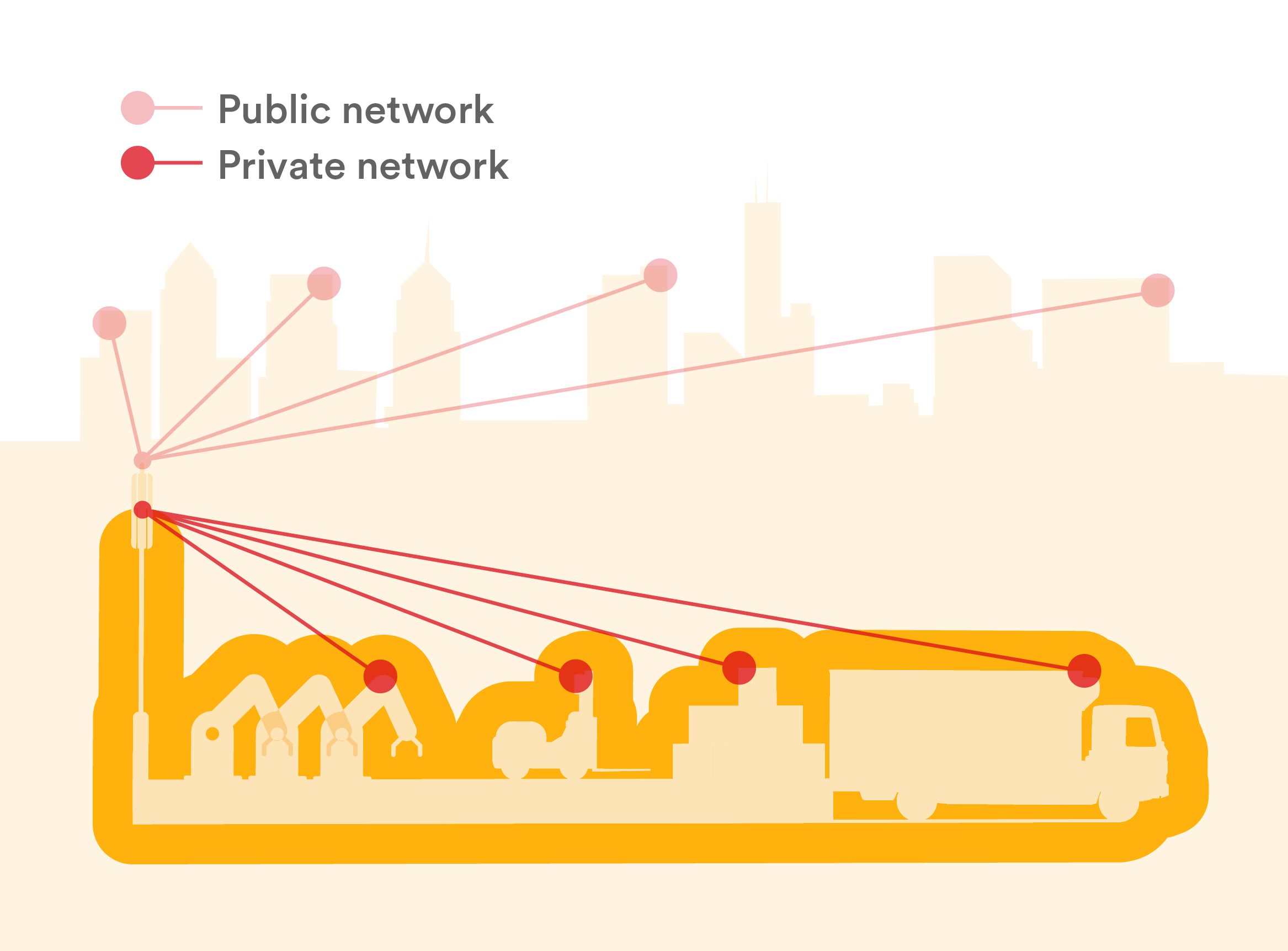

Deutsche Telekom is a forward-thinking operator that is testing a campus network which employs their licensed spectrum in order to wirelessly connect machines in a real production environment. A separate private LTE network has been built on the factory campus alongside the public network. This approach provides independent use of resources and network capacities because the custom-built network is reserved for their exclusive use. In addition, the solution enables one-way access to the public network.

Druid Software is a private network pioneer, having deployed their first solution in a Dutch hospital back in 2011. It and all subsequent solutions are built on the company’s Raemis™ platform, which is a set of cellular software assets that are optimised for business use cases. Druid, together with its systems integrator, deployed a large, automated LTE solution three years ago that uses unlicensed spectrum in the Port of Rotterdam, which is one of the largest and most important ports in the world.

Expeto is a venture-backed, Canadian company: a new entrant that was established in 2016. Expeto markets an innovative solution that provides seamless roaming between private and public networks while retaining Wi-Fi type management. The company’s seamless combination of public and private networking involves expanding and extending the functionality of the EPC, which is deployed in a Platform as a Service(PaaS) model.

An open market for suppliers

Private LTE and, in the future 5G, networks represent a market that is driven by the communications requirements of the business community, facilitated by recent developments in the deployment of spectrum, and enabled by innovative suppliers. It encompasses new opportunities for MNOs, MVNOs, hardware and network infrastructure vendors, and many other participants in the enterprise IoT market.

Bob Emmerson

Technology Editor, Beecham Research.